Orderbook

Orderbook |

|

How to openOrderbooks can be opened by:

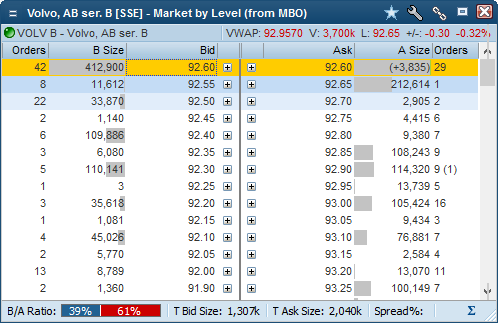

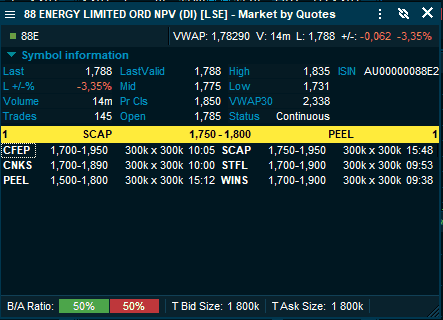

GeneralOrderbooks displays public buy and sell orders and are available as MBO (Market by order) and MBL (Market by level). Infront offers access to both Level 1 data and Level 2 data as well as consolidated orderbooks (combines orderbooks from the main listing exchange with multilateral trading facilities). The order book window can be linked with order windows, see Linking windows for more information. For selected markets the Orderbook can be displayed differently, e.g FX or Fixed Income data. Example

The example shows a MBO orderbook (left) and a MBL orderbook (right)

Market by Level (MBL) Orderbook - In this kind of orderbook all the public orders on a symbol from a specific exchange are accumulated into unique price levels. So if there are 35 orders at 52,30 SEK, there will be only one level in the orderbook with an accumulated volume of 55,748.Market by Order (MBO) Orderbook - The Market by Order orderbook contains all details o single orders in the public orderbook. An MBO orderbook may contain a large number of orders with exactly the same price. So you get much more detailed information about each order in the market.Trading - If you place an order through a trading service using Infront, the orderbook will highlight the price level that matches the price of your active order (green below). The feature is on by default, but can be turned off in Settings. |

| • | Summery line 1: Symbol ticker / Symbol description / VWAP / Volume / Last / Net change / Net Change % |

| • | Summery line 2: ISIN / Feed code / Feed name / Symbol code / Symbol Status / High / Low |

If an instrument (normally a stock) is suspended, the Orderbook will automatically be displayed with a X mark. It is also possible to define a color for a suspended quote under Edit colors ”Background if Status Set".

Display imbalance volume in an opening or closing auction on the following exchanges; Xetra Frankfurt, Euronext Paris, Copenhagen, Helsinki, Stockholm, Oslo.

The screen shot below shows the current imbalance in the orderbook, it is 3 835 shares more offered than what will actually uncross in the auction. Uncrossing volume being 412 900.