How to open

Intraday charts and historical charts can be opened in several ways.

1.Right click on a symbol in a market window, watchlist or a market page and select "Charts and visualizations" --> "Intraday chart (Ctrl + I)" or a "Historical chart (Ctrl +H)".

2. Search for "IntradayChart", "HistChart" or "Chart" in the Find Anything search field.

3. Use the shortcuts "Ctrl + I" to open intraday charts and "Ctrl + H" to open historical charts.

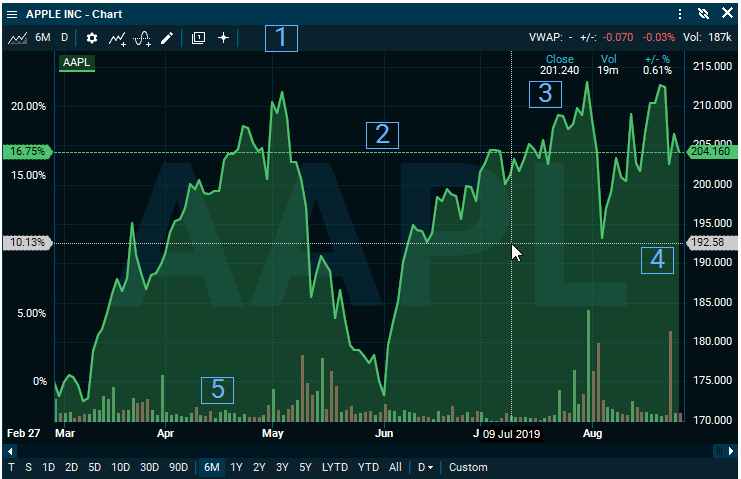

Default chart

•Toolbar: Here you can find the cursor, chart templates, annotations, studies, compare studies, chart settings, resolution, time-period and chart type.

•Price Line: Visually indicate the current price level.

•Hoover data: When cursor is on, a data-table is displayed for the selected date.

•Hoover Price: Price level on the right axis.

•Volume Bars: Are displayed in the background as a visual indicator.

Toolbar

Cursor

![]()

Turn on and off the cursor by clicking on the cursor symbol.

Templates

![]()

Find your templates by clicking on the Templates button. Chart Templates can be used for several purposes such as:

• Create a default charting layout

• Create different technical analysis templates

• Quickly change charting layout without manually adding removing or adding elements to the chart

• Create several color themes for different chart types.

You can also restore factory default, save and load your templates. All your saved templates will be placed in your ontrade\Setup folder.

Settings

![]()

Change your chart settings by clicking on the gear icon in the chart toolbar. From here it’s also possible to revert back to the old chart setup, used in the Infront Terminal in the 8.5 versions and earlier. Among other things, the settings can:

•Choose axis

•Target currency

•Chart type (Area, Candle Stick, Line etc.)

•Line style

•Extend the chart

•Show chart data

•Show events

•Adjust for splits/dividend

•Change back to the legacy toolbar / summary bar

Annotations

![]()

Add annotations to your chart. This can be lines, channels, circles, arrows or for example long/short positions. Note that you have to hold CTRL on the keyboard to draw the annotations. If you want to delete, edit or change the coordinates, right click on the annotations to prompt the different options.

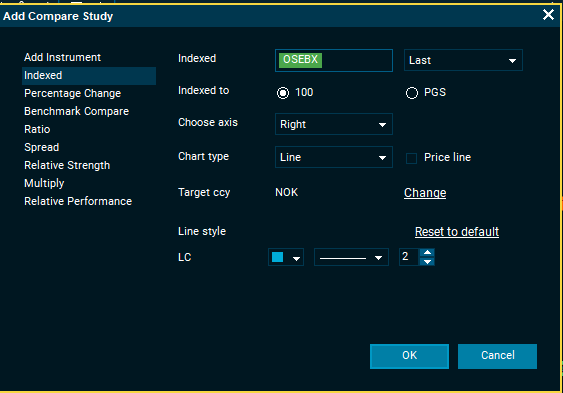

Add compare study

![]()

Compare studies to different instruments by choosing a study comparison. By adding an instrument, you can also change axis, currency or line style. The compare study can be also be indexed, see percentage change, benchmark compared and much more.

Add study

![]()

Add studies to your charts like for example Moving Averages, Bollinger Bonds, RSI, Standard Deviation and much more. You can also select Instrument/Line, axis, period and line style for the different studies. The chart also update in the background before clicking “ok”, making it easy to see how the changes are reflecting in the chart. Please note that it’s not required to hold down CTRL when using Line Snap. In order to use the Line Snap, make sure the cursor is turned on and mark a point on the chart to generate a starting point.

Resolution, time period and chart type

![]()

In the options in the top left, you can change chart type, time period and resolution.

Study Definitions

Average True Range (ATR) - measures volatility. High ATR often occur at market bottoms following a panic sell-off. Low ATR value is often found during extended sideways periods, such as those found at tops and after consolidation periods. |

Chande Momentum Oscillator (CMO)

Chande Momentum Oscillator (CMO) - is created by calculating the difference between the sum of all recent gains and the sum of all recent losses and then dividing the result by the sum of all price movement over the period. This oscillator is similar to other momentum indicators such as the Relative Strength Index and the Stochastic Oscillator because it is range bounded (+100 and -100). |

Commodity Channel Index (CCI) - quantifies the relationship between the price, a moving average (MA) of the price, and normal deviations from that average. The index is scaled by a factor of 1/0.015 to provide more readable numbers. Therefore, it is essentially a MACD, normalized the deviation. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period. |

Directional Movement DI+/DI- (DI)

Directional Movement DI+/DI- (DI) - helps determine if a security is ”trending”. The DMI trading system involves comparing the 14-day DI+ (”Directional Indicator Up”) and the 14-day DI- (”Directional Indicator Down”). This can be done either by plotting the two indicators on top of each other or by subtracting the DI+ from the DI-. Wilder, who developed the system, suggests buying when the DI+ rises above the DI- and selling when the DI+ falls below the DI-. |

Directional Movement ADX (ADX)

Directional Movement ADX (ADX) - The Average Directional Movement Index (ADX) is an averaged combination of DI+ and DI- which serves as an indicator of the trend strength. The ADX is as an oscillator fluctuating between 0 and 100. Low readings (below 20), indicate a weak trend and high readings (above 40) indicate a strong trend. |

Directional Movement ADXR (ADXR)

Directional Movement ADXR (ADXR) - The Average Directional Movement Rating quantifies momentum change in the ADX. It is calculated by adding two values of ADX (the current value and a value n periods back), then dividing by two. This additional smoothing makes the ADXR slightly less responsive than ADX. The interpretation is the same as the ADX; the higher the value, the stronger the trend. |

Directional Movement DX (DX) - The Directional Movement Index combines the two DI+ and DI- lines of the DI analyses into one line. |

High/Low Oscillator (HLO) - a simple model that use today and yesterday’s price to determine an oversold/overbought situation. If the HLO curve is above zero it indicates an overbought situation. Similarly, if the HLO curve is below zero it indicates an oversold situation. |

Intraday Momentum Index (IMI) - is an oscillator which is constructed by averaging n day's worth of upward price changes (close is greater than open) to n day's worth of downward price changes (close is less than open). Sell signals are issued when the index crosses above the overbought level of 70% and buy signals are issued buy signals are issued when the index crosses below the oversold level of 30%. |

Market Facilitation Index (FI)

Market Facilitation Index (FI) - analyzes the amount that the price is changing for each unit of volume. It does not include any information concerning the direction of price changes. Instead, it is used to determine the efficiency with which the price is changing. The value of this indicator is the difference between the high and low prices divided by the volume. Therefore, its value tends to be very small. |

Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD) - calculated by subtracting a 26 day moving average of a security’s price from a 12 day moving average if its price. A 9-day exponential moving average called ”signal” or ”trigger” line is plotted on the top of the MACD to show buy/sell opportunities. The result is an indicator that oscillates above and below zero. When MACD is above zero, it means that the 12-day moving average is higher than the 26 day moving average. This is bullish; since it shows that recent expectations (i.e. the 12 day moving average) are more bullish than previous expectations (i.e. the 26 day moving average). This implies bullish (upward) shift in supply/demand lines. When MACD falls below zero, it implies that the 12-day moving average is below the 26-day moving average, implying a bearish (downward) shift in supply/demand lines. |

Price Oscillator - almost identical to the MACD, except that it can use any two user-specified moving averages and can display the difference in either points or percentage (MACD displays only points) |

QStick - provides a way to quantify the amount and size of black and white bars in a Candlestick chart. Black candlesticks represent a period when the price closed lower than it opened. Likewise, the white candlesticks represent a period when the price closed higher than it opened. |

Rate of Change (RC) - displays the difference between the current price and the price ”n” time periods ago. The RC displays the wavelike motion in an oscillator format by measuring the amount that prices have changed over a given time period. As prices increase, the RC rises - as prices fall the RC falls. The greater change in the price, the greater the change in RC. |

Relative Momentum Index (RMI) - a variation on the Relative Strength Index (RSI) that adds a momentum component. As an oscillator, the RMI exhibits the same strength and weakness of other overbought/oversold indicators. During strong trend markets, the RMI will remain at overbought or oversold levels for an extended period. During non-trending markets the RMI tends to oscillate predictably between an overbought level of 70 to 90, and oversold level of 10 to 30 |

Relative Strength Index (RSI) - is a price following oscillator that ranges between 0 and 100. A method for analyzing RSI is to look for divergence in which the security is making a new high but the RSI is failing to surpass its previous high. This divergence is an indication of an impending reversal. When the RSI then turns down and falls below its most recent trough, it is a confirmation of the impending reversal. |

Relative Volatility Index (RVI)

Relative Volatility Index (RVI) - measures the direction of volatility. The calculation is identical to the Relative Strength Index (RSI) except that the RVI measures a 10-day standard deviation of high and low prices instead of measuring period-to-period price changes. RVI rules of confirmation:

• Only act on by signal when RVI >50 • Only act on sell signals when RVI <50 • If a buy signal was ignored, enter long when RVI>60 • If a sell signal was ignored, enter short when RVI<40 • Close a long position if RVI falls below 40 • Close a short position if RVI rises above 60

|

Standard Deviation (SD) - a statistical measure of volatility. Typically used as a component of other indicator. High standard deviation values occur when the data item being analyzed is changing dramatically. Low standard deviation values occur when prices are stable. |

Stochastic Oscillator (SO) - displays overbought and oversold levels. The SO consists of two lines where one is a 3-day average of the other. It should only be used in situations without a dominating tend. |

Volatility (VOL) - indicator that compares the spread between a symbol’s high and low prices. It assumes that market tops are generally accompanied by decreased volatility, and that the latter stages of a market bottom are generally accompanied by decreased volatility. |

Williams %R (WR) - measures overbought/oversold levels. Very similar to Stochastic Oscillator, except that Williams %R is plotted upside down and the Stochastic Oscillator has internal smoothing. |

Williams Accumulation/Distribution (WAD)

Williams Accumulation/Distribution (WAD) -”Accumulation” is used to describe a market controlled by buyers, a market controlled by sellers defines ”distribution”. Williams recommend trading on divergences:

• Distribution of the security is indicated when it is making a new high and the Acc./Distr. Indicator is failing to make a new high - Sell.

• Accumulation of the security is indicated when it is making a new low and the Acc./Distr. Indicator is failing to make a new low - Buy. |