Access requirements

•Access to Trading server with Algo support

•Access to Smart Order Trading feature

How to access

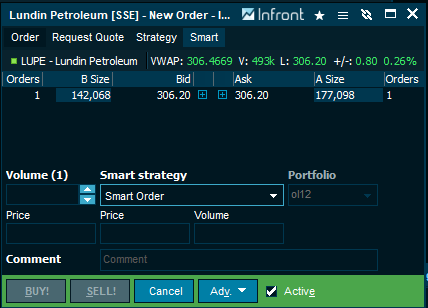

•Select the Smart Order page of the New Order window

•From the Consolidated Orderbook window, Smart order is the default order type

Description

Smart Orders are orders that can be executed on one or more exchanges that all have the same company listed. This is can be useful in automatically dividing a large order on multiple exchanges and getting a better average price than would be possible if the order was executed only on a single exchange.

For instance, the Swedish Ericsson company is listed on several exchanges, including the Stockholm Stocks Exchange and on MTF (Multilateral Trading Facility) feeds such as Turquoise, Chi-X, Nasdaq OMX Europe and Burgundy. When you send a Buy Smart Order on Ericsson to a server that supports these markets, your order may trade on all of these exchanges.Enter topic text here.

A Smart Order is a special case of the more general concept of Algo Trading. The details of how your Smart Order is executed on the different exchanges is delegated to a separate 3rd party Algo or Smart Order server.

Just as with Algo trading you can be presented with a list of named Smart Order algorithms and each order may take a number of input parameters.

The user selects from the list of Smart Order strategies, fills in the mandatory parameters and sends the order to the server. Then the server monitors conditions such as cross-market prices, volumes, time etc and enters and cancels orders to try and fulfill the purpose of the strategy.