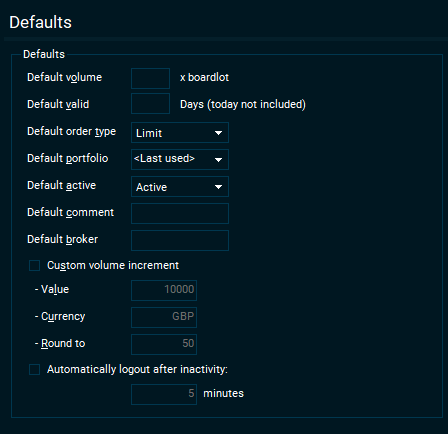

Default

Default volume - Set the default board lots you wish to see in the order entry window. (A board lot is a standardized number of shares defined by a stock exchange as a trading unit).

Default valid - The number of days an order should be valid for.

Default order type - When opening an order entry window, this setting allows you to specify the default order type

Default portfolio - Useful if you have access to more than one portfolio.

Default active - Orders can be sent as active or inactive to your trading service.

Default comment - Some trading services allow for comments to be sent. Use Default comment if you would like to include information in a comment by default.

Default broker - Select your preferable broker

Custom volume increment - The volume field of an order entry window can be made to increase or decrease by a certain amount when clicking on the up and down arrows or using the up and down arrows on your keyboard.

Limits

Limit per order - set the currency value per order as a limit. If you exceed the limit per order, the gross price field will highlight in a red color and you will receive a warning.

Limit per day - As with the limit per order, you can also specify a currency value limit per day. You will also receive a warning.

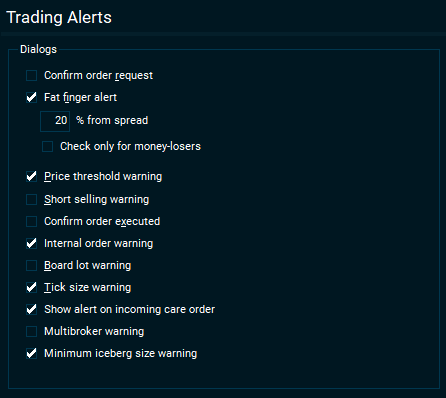

Trading Alerts

Confirm order request - If this is ticked, then you will be asked to confirm before the order is placed.

Fat finger alert - Specify how far away from the current bid/ask spread the price you enter should be before it triggers a warning. This is useful to safeguard against typing in extra numbers by accident. In the example below, the user typed in 2000 instead of 200 as the price.

Short sell warning - Checks the volume of long positions in your portfolio for an instrument you are selling and warns you if you are selling more than you own.

Confirm order executed - Get a confirmation when the trading service confirms your order as executed.

Tick size warning - Warns you when the price you enter violates tick size rules of the exchange or market place.

Show alert on incoming care orders - Get an alert if a care order has been received from the trading service.

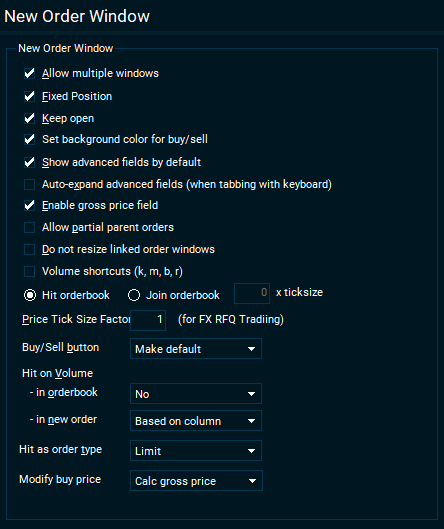

New Order Window

Allow multiple windows - By default only one is shown in the terminal.

Keep open - When an order has been placed, the default is to close the new order window. Use this setting to keep the new order window open.

Set background color for buy/sell - When placing a buy or sell order via the right-click menu or via keyboard shortcuts, the background color of the new order window will be colored green for buy orders and red for sell orders.

Shows advanced fields - When opening a new order window, defines whether the advanced fields should be shown immediately or hidden until you click on Adv.

Auto-expand advanced fields - If shows advanced fields is turned off, tabbing with your keyboard through the new order window will make the advanced fields show up automatically after gross price.

Enable gross price field - The gross price field is displayed in an order entry window. This option switches on the ability to type in your own gross price. If you have also entered a price, then the closest volume corresponding to the gross price will be calculated for you. In the example below a price of 347 and gross price of 100,000 was entered. The terminal then calculated a volume of 288 automatically.

Do not re-size linked order windows - in a compact workspace, it may be desirable to not re-size the new order window when changing instruments.

Hit orderbook, join orderbook - When opening an new order window buy clicking BUY (or SELL)

- Hit orderbook will place the price at the best ask price (best bid price for SELL orders)

- Join orderbook will place the price as the best bid price (best ask price for SELL orders)

Price Tick Size Factor - Only available for FX RFQ trading - When increasing or decreasing the price of a new order with the up and down arrows, will multiply by a factor of X with the tick size rules. Example: If the factor is set to 3, and the tick size is 0.0001, then clicking up the up arrow on the price field will increase the price by 0.0003.

Buy/Sell button - When opening a new order window by clicking on BUY or SELL from a right click menu or using keyboard shortcuts. This setting defines the behaviour of the BUY and SELL buttons.

- Normal - Both buy and sell buttons show up and function as normal

- Make default - The BUY or SELL button (depending on what you choose) will be highlighted and pressing ENTER on your keyboard will cause the order to be placed.

- Disable other - Will show you but not allow you to click on the SELL button if you have chosen to BUY from the right-click menu or keyboard shortcuts. (disabled the buy button if you have chosen to sell)

- Hide other - If you have chosen BUY from the right-click menu or keyboard shortcuts, the SELL button will be hidden (hides the buy button if you have chosen sell)

Hit on volume -

- in orderbook

- in new order

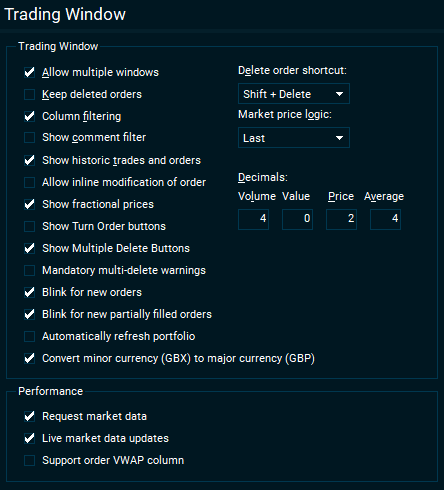

Trading Window

The trading window is where you can see all orders, trades and your portfolio positions.

Allow multiple windows - Default is to only show one.

Keep deleted orders - If selected, then deleted orders will also be shown in the orders tab.

Column filtering - Allows the user to filter orders based on various criteria. Below is an example where it is possible to choose to only show portfolio positions in a particular currency.

Allow inline modification of order - Allows the user to edit an order's price or volume by clicking in the field (orders tab) without having to open an modify order window.

Show fractional prices - For some markets, the convention is to use fractions instead of decimals.

Show Turn Orders buttons - For active orders, this feature allows you to change a buy order to a market sell order (Turns sell orders to market buy orders). These buttons show up in the orders tab.

Show multiple delete buttons - If this feature is off, then only one delete button is shown. Select the order and delete it. If it is turned on, three extra options are available: "Delete Buy", "Delete Sell", "Delete All".

Blink for new orders - New orders placed will blink in the orders tab

Blink for new partially filled orders - Partially filled orders placed will blink in the orders tab

Automatically refresh portfolio - When an order is placed or executed, check for updates to the portfolio.

Performance-

- Request market data - The terminal will request the market data even if the user has not opened the market in their workspace. Switch this off for a small performance boost if you have a very large portfolio

- Live market data

- Support order VWAP column