In general

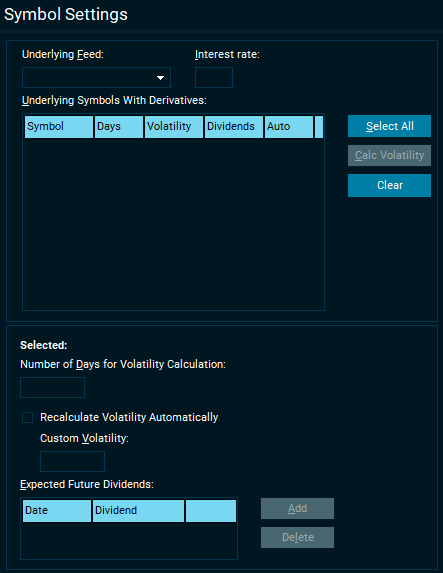

Underlying feed - the settings will apply to all underlying symbols for the options feed you select

Interest rate - Many calculations require an interest rate in order to calculate the values. Specify an interest rate here you wish to use.

Selected - Once you have selected some underlying symbols, you can set custom volatility periods, and have them recalculate automatically. Alternatively, set a custom value for volatility.

Advanced

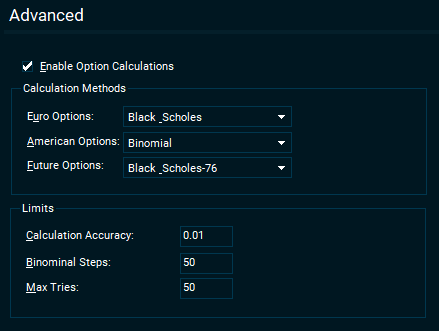

The General page contains instructions on the requirements of running the option calculations. You can check out the ”Enable Option Calculations” from the advanced tab if you don’t want to have these calculations executed.

Enable option calculations - If enabled, the terminal will calculate 'greeks' using the specified pricing methods.

Limits - Settings for the various option pricing methods.

Volatility

Volatility measures how much the underlying instrument is expected to change over time. This value is needed by the option calculations and must be set manually in this dialog.

Note: Calculating the historical volatilities may take some time.

Select the feed and the underlying instrument. The list of feeds will only include the active underlying feeds of the currently loaded option feeds. |

Determines the basic risk-free rate for the market as a whole. This default value is 5%. |

Select symbol(s) in the list and press the Set Volatility button to change the volatility value. This requires that you have determined a preferred volatility value for each underlying symbol. You can alternatively have the server calculate a historical volatility. The server calculates the actual volatility of the underlying instrument for the last number of days. 20 days is used as default, but you can override this by selecting the symbol(s) and pressing the Set Days button. When you are ready, select the symbol(s) and press the Calc Volatility button.

The Select All button easily lets you select all the underlying symbols in the list.

Note: Calculating the historical volatilities may take some time. You may close the Option Calculation Setup dialog, and the volatilities will still be calculated and updated correctly as they are received from the server. You will get a notification about this, but this message can be suppressed in the future by checking the ”Don’t show this message again” checkbox. |

If the company of the underlying instrument are planning to pay dividends in the future (but before the option expires), this will influence the option price. To ensure that the calculations are adjusted accordingly, enter the dividend date and amount here. Each underlying instrument may have any number of future dividends registered. Only dividends inside the expire period will be considered during the calculations. Use the Add button to add new dividends. Use the Delete button to remove a dividend. |

The option calculation engine supports three different option models. Each method is used for different kinds of options as indicated by the default values in the dialog. |

This is option-pricing model was first introduced by Fischer Black and Myron Scholes in 1973. It is used for European options (such as the OBX options on Oslo Options). European options cannot be exercised before the expire date. |

John Cox, Stephen Ross and Mark Rubinstein introduced the Binomial Option-pricing Model in 1979. It is used for American options (such as the NHY options on Oslo Options). American options can be exercised any time up to and including the expire date. |

This option-pricing model is a variation of the standard Black & Scholes model, and was presented by Fischer Black in 1976. This model is used when the underlying instrument is a future contract. |

The option calculation engine will produce results of a specific accuracy. The minimum acceptable accuracy can be specified here. Also, the engine relies of iterating through a number of calculations, increasingly finding a more accurate answer. The maximum number of iterations can also be set here. |