Description

SME Direkt Level 1 provides fundamental data on Nordic companies with results, estimates and recommendations.

Data content included per company the in SME Direkt Level 1 package:

| • | EPS (Earnings per share) |

| • | DPS (Dividends per share) |

| • | Last year’s reported result |

| • | Next year’s estimated numbers (median) |

Requirements

| • | Subscription to an SME Direkt package |

How to access

| • | In an SME Direkt Consensus Estimates section the Details page of the Symbol Window |

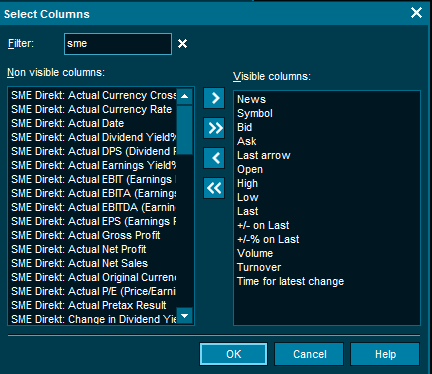

| • | As columns in the Market and Composite windows |

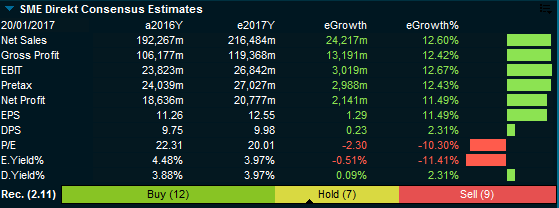

SME Direkt Consensus Estimates section

The SME Direkt Consensus Estimates is included as a section in the Details page of the Symbol Window.

Each line in the grid shows last year’s result (or actual), next year’s estimated, nominal change and percentage change for each of the available key figures. The last column shows the percentage change graphically. This gives a quick overview of the expected changes in the coming year.

The date in the upper left corner of the grid shows the date the estimates was last updated. Note that all key figures may not be available (or applicable) to all companies.

Currency conversions

For some results and estimates, the currency of the original values differ from the stock's trading currency. In these cases, the application will convert the values back to the trading currency, using historical currency rates (from the fiscal year end or estimated date). The currency crosses and rates used are then displayed above the other key figures.

The currency cross values used are the closing value from a historical date. For actual results, the date is the end of fiscal year date (say December 31st 2008). For estimated values, the date is the date of the estimation update (say June 12th 2009).

Recommendation bar

At the bottom of the section is a graphical representation of the recommendations from the analysts. It shows up to 5 different level of recommendations: Strong buy, Buy, Hold, Sell and Strong Sell. Each level is color-coded with shades of green for buy, yellow for hold and shades of orange and red for sell.

The number of votes in each category is shown and the width of the color bar is relative to the total number of votes. The middle of the recommendation bar is indicated with a small black arrow and indicates the balance point or average recommendation value. The same value is shown numerically in the label to the left of the bar. The average recommendation value range is from 0 (Strong sell), via 2 (a neutral Hold) to 4 (Strong Buy).

Hover the mouse over the recommendation bar to see the date of the recommendations and full descriptions of all values.

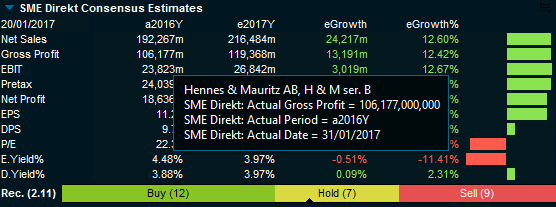

Hints with more detailed information

If you hover the mouse over the value columns, additional information will be shown for that value.

List of SME Direkt columns

The following is a sorted list of all available SME Direkt columns included in the Level 1 package.

| • | Actual DPS (Dividend Per Share) |

| • | Actual EBIT (Earnings before interest and taxes) |

| • | Actual EBITA (Earnings before interest, tax and amortization) |

| • | Actual EBITDA (Earnings before interest, taxes, depreciation and amortization) |

| • | Actual EPS (Earnings Per Share) |

| • | Actual Original Currency |

| • | Actual P/E (Price/Earnings Ratio) |

| • | Actual Yield% (100 * DPS / Last) |

| • | Change in DPS (Dividend Per Share) |

| • | Change in EBIT (Earnings before interest and taxes) |

| • | Change in EBITA (Earnings before interest, tax and amortization) |

| • | Change in EBITDA (Earnings before interest, taxes, depreciation and amortization) |

| • | Change in EPS (Earnings Per Share) |

| • | Change in P/E (Price/Earnings Ratio) |

| • | Change in Yield% (100 * DPS / Last) |

| • | Estimated Currency Cross |

| • | Estimated DPS (Dividend Per Share) |

| • | Estimated EBIT (Earnings before interest and taxes) |

| • | Estimated EBITA (Earnings before interest, tax and amortization) |

| • | Estimated EBITDA (Earnings before interest, taxes, depreciation and amortization) |

| • | Estimated EPS (Earnings Per Share) |

| • | Estimated Original Currency |

| • | Estimated P/E (Price/Earnings Ratio) |

| • | Estimated Yield% (100 * DPS / Last) |

| • | Percentage change in DPS (Dividend Per Share) |

| • | Percentage change in EBIT (Earnings before interest and taxes) |

| • | Percentage change in EBITA (Earnings before interest, tax and amortization) |

| • | Percentage change in EBITDA (Earnings before interest, taxes, depreciation and amortization) |

| • | Percentage change in EPS (Earnings Per Share) |

| • | Percentage change in Gross Profit |

| • | Percentage change in Net Profit |

| • | Percentage change in Net Sales |

| • | Percentage change in P/E (Price/Earnings Ratio) |

| • | Percentage change in Pretax Result |

| • | Percentage change in Yield% (100 * DPS / Last) |

| • | Recommendations Average score |

| • | Recommendations Strong buy |

| • | Recommendations Strong sell |

|